Flourish Excel, producido por Seachem, es un popular potenciador de carbono líquido diseñado para acuarios plantados. Este producto ofrece una fuente de carbono orgánico que puede ser absorbido fácilmente por las plantas acuáticas, ayudándolas a crecer de manera saludable y a desarrollar colores vibrantes. Aquí tienes una descripción detallada de [...]

Leer másAcuariofilia | Web Especializada

Bienvenidos a Acuariofilia.es

Explora el fascinante mundo de la acuariofilia y sumérgete en nuestra plataforma informativa diseñada para entusiastas y aficionados por igual. Desde consejos prácticos sobre el cuidado de peces y plantas acuáticas hasta reseñas detalladas de los últimos productos y equipos disponibles en el mercado, en Acuariofilia.es encontrarás todo lo que necesitas para crear y mantener un acuario vibrante y saludable.

Nuestro equipo está comprometido en proporcionarte recursos útiles y actualizados, así como en responder a todas tus preguntas y preocupaciones relacionadas con la acuariofilia. Además, te ofrecemos artículos educativos sobre temas variados, desde la ciclación del acuario hasta la reproducción de peces, para que puedas expandir tus conocimientos y mejorar tus habilidades como acuarista.

Además de ser una valiosa fuente de información, Acuariofilia.es también es una comunidad en línea donde puedes conectarte con otros entusiastas, compartir tus experiencias y aprender de las historias y consejos de los demás. Únete a nuestra creciente comunidad y sumérgete en conversaciones apasionantes sobre todo lo relacionado con la acuariofilia.

En Acuariofilia.es, nos apasiona brindarte la mejor experiencia posible en tu viaje acuático. Así que no esperes más, ¡explora nuestro sitio y sumérgete en el maravilloso mundo de la acuariofilia con nosotros!

Seachem es una reconocida marca en el mundo de la acuariofilia, conocida por producir productos de alta calidad para el cuidado de los acuarios. Cuando se trata de abonos para plantas de acuario, Seachem ofrece una variedad de opciones que pueden satisfacer las necesidades de diferentes tipos de acuarios y plantas. A continuación, te presento [...]

Leer másEl cloro presente en el agua del grifo puede resultar perjudicial para los peces y otros organismos acuáticos en tu acuario. Afortunadamente, existen varios métodos efectivos para eliminar el cloro y preparar el agua de manera segura para tus peces. Descubre como quitar el cloro al agua para tu acuario en este artículo y los diferentes productos [...]

Leer másLos peces vivíparos son una categoría fascinante dentro del reino acuático, destacándose por su capacidad única de dar a luz crías vivas en lugar de poner huevos. A continuación, profundizaremos en las características, hábitats, comportamientos y cuidados de estos peces, centrándonos en algunas de las especies más comunes y sus aspectos más [...]

Leer másEl Pez Molly, científicamente conocido como Poecilia sphenops, es una especie popular en acuarios de agua dulce debido a su hermoso colorido y comportamiento activo. La alimentación para el Pez Molly es vital para mantener a estos peces saludables y felices, por ello, es importante proporcionarles una alimentación adecuada y variada que satisfaga [...]

Leer másEl Pez Piedra de Agua Dulce, también conocido por su nombre científico Batrachomoeus trispinosus, es una fascinante especie de pez que habita en ríos y arroyos de América del Sur. A continuación, exploraremos algunas características y aspectos destacados de este intrigante habitante de los ecosistemas acuáticos: Descripción El Batrachomoeus [...]

Leer másEl pez piedra, una criatura sorprendente y temida de los arrecifes, posee una habilidad extraordinaria: puede sobrevivir fuera del agua durante hasta 24 horas. Esta capacidad única lo convierte en un maestro de la supervivencia en su hábitat costero. Adaptación al Entorno Costero: Los peces piedra, miembros de la familia Synanceiidae, habitan en [...]

Leer másEl Pez Piedra, perteneciente a la familia Synanceiidae, es uno de los habitantes más tímidos y venenosos de los arrecifes. Hoy te ofrecemos los datos más interesantes del Pez Piedra. Con trece espinas en su aleta dorsal, su picadura puede ser mortal para los seres humanos. Se encuentra en gran número en las regiones costeras de los océanos Indo [...]

Leer másLos Goldfish, o peces dorados, son una especie popular en la acuariofilia, apreciada por su belleza y tranquilidad. Debido a esto, muchas personas se preguntan cómo sexar los Goldfish, ya que pueden tener diferencias sutiles pero importantes entre machos y hembras. En esta guía, exploraremos las características físicas y comportamentales que te [...]

Leer másEn las costas de Taiwán, a finales de Julio de 2023, un evento inusual y misterioso capturó la atención de buceadores, científicos y entusiastas de la vida marina: la aparición del enigmático Pez Remo Gigante, también conocido como el “pez del fin del mundo” debido a su posible relación con terremotos y tsunamis. Ahora, a principios [...]

Leer másLa aparición del Pez Remo, también conocido como Pez Remo Gigante, es un fenómeno extraño que ha intrigado a la humanidad a lo largo de la historia. El aspecto peculiar de esta criatura misteriosa y su hábitat en las profundidades oceánicas lo convierten en una especie fascinante, pero también en objeto de mitos y leyendas en diversas culturas [...]

Leer másEl pez remo gigante, también conocido como Regalecus glesne, es una especie marina de pez óseo que se encuentra entre los peces óseos más largos del mundo. Conocido por su aspecto sorprendente y su tamaño impresionante, el pez remo gigante habita en aguas profundas y templadas en océanos de todo el mundo. Su apariencia única y su comportamiento [...]

Leer másHoy nos adentraremos en la fascinante clasificación de peces según su reproducción. Acompáñanos en este inmersivo viaje bajo el agua y descubramos juntos la maravillosa diversidad que ofrecen nuestros amigos acuáticos. Clasificación de Peces de Acuario según su tipo de Reproducción En el apasionante mundo de la Acuariofilia, tener un conocimiento [...]

Leer másLa iluminación de acuario es un aspecto fundamental en el mantenimiento de un acuario saludable y estéticamente atractivo. Aquí encontrarás todo lo que necesitas saber sobre la iluminación de acuarios, desde la tecnología LED hasta la cantidad de luz necesaria para diferentes tipos de acuarios. Acuario con Luz LED: Los sistemas de iluminación LED [...]

Leer másCómo decorar un acuario de agua dulce es pregunta compleja en el mundo de la acuariofilia que no sólo se basa en colocar elementos dentro de un acuario o tanque, si no que permite crear un mundo submarino cautivador que refleja tu creatividad y estilo personal. Desde el acuario aquascaping hasta el diseño de paisajes acuáticos, aquí tienes todo lo [...]

Leer másLos peces compatibles con guppys son aquellos que comparten requisitos de agua similares y tienen comportamientos pacíficos que no amenazan la seguridad ni el bienestar de los guppies. Al elegir compañeros de tanque para tus guppies, es importante considerar factores como el tamaño del tanque, la temperatura del agua y la compatibilidad de [...]

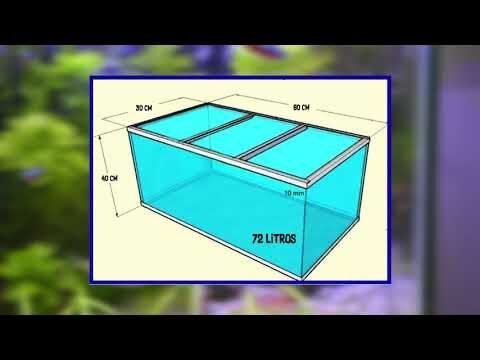

Leer másEn este artículo vamos a aprender de forma sencilla a cómo calcular cuántos litros tiene un acuario. También veremos cómo convertir galones a litros (ya que muchas veces nos dan el volumen de un acuario en galones, y necesitamos su equivalencia en litros). Antes de nada, has de tener en cuenta 2 cosas: 1) El largo, ancho [...]

Leer másLos cíclidos conchícolas del Lago Tanganika son una fascinante variedad de peces cíclidos que habitan en las aguas del lago Tanganika en África. Se caracterizan por su comportamiento único y su adaptación a un estilo de vida asociado con las conchas de caracoles. Estos cíclidos son altamente apreciados en la acuariofilia debido a su comportamiento [...]

Leer más¿Cómo Hervir Troncos y Raíces para Acuarios? Los troncos y raíces son elementos naturales que pueden agregar belleza y un toque orgánico a tu acuario. Sin embargo, antes de colocarlos en tu tanque, es crucial asegurarse de que estén libres de cualquier organismo no deseado y de que no afecten la química del agua. Hervir troncos y raíces es un [...]

Leer másLos cíclidos africanos del Lago Tanganika son forman parte de las fascinantes especies de peces que habitan en uno de los Grandes Lagos Africanos, el Lago Tanganika. Aquí hay algunos datos interesantes sobre estos peces: Descripción de los Cíclidos Africanos del Lago Tanganika: El Lago Tanganika es uno de los lagos más antiguos y grandes del [...]

Leer másDescubre los mejores troncos y raíces para acuarios. Introducir raíces en tu acuario es una excelente manera de añadir un toque natural y orgánico a tu paisaje acuático. Además de su belleza estética, las raíces pueden proporcionar refugio, áreas de reproducción y sustrato para el crecimiento de plantas. En este artículo, exploraremos los [...]

Leer másDescubre las mejores rocas y piedras para acuarios de agua dulce. En el mundo del acuarismo, la elección de las rocas y piedras adecuadas para tu acuario es fundamental para crear un paisaje acuático cautivador. En este artículo, exploraremos detalladamente los tipos de rocas disponibles, sus características individuales y cuáles son las más [...]

Leer másLos océanos y ríos del mundo albergan una diversidad impresionante de criaturas, y entre ellas, algunos de los peces más venenosos que existen. En realidad, hay más peces venenosos que serpientes e invertebrados venenosos juntos. Estos peces poseen características distintivas que advierten su peligrosidad, como su coloración llamativa o las [...]

Leer másHay una gran variedad de Goldish, y en esta sección vamos a redescubrir las variedades más conocidas del Pez Telescopio, una variedad de Goldfish con ojos protuberantes y elegante nado, que se han convertido desde hace años en una opción popular entre los aficionados a los acuarios debido a su aspecto distintivo y su comportamiento fascinante. A [...]

Leer másDescubre como cuidar un Pez Telescopio, también conocido como “Goldfish telescopio” o “Ojos de burbuja”. Este es una variedad de goldfish conocida por sus grandes ojos saltones y su cuerpo redondeado, para el cual debemos llevar a cabo un buen control de la calidad del agua hasta una elección adecuada de la decoración, que [...]

Leer másDesubre los datos más curiosos del Pez Escorpión, un ejemplo fascinante de adaptación y peligro en el mundo marino. Su capacidad de mimetismo, su veneno letal y su estilo de caza sigiloso lo convierten en una criatura digna de respeto y cautela para todos aquellos que se aventuran en sus hábitats naturales. 1. Mimetismo Mortal: El Pez Escorpión [...]

Leer másEl Pez Verde, también conocido como Fredy Thalassoma pavo, es una especie de pez de arrecife que pertenece a la familia Labridae. Son conocidos por su coloración vibrante y su comportamiento activo en los arrecifes de coral. A continuación, se detallan algunas características y aspectos relevantes de este fascinante pez: Descripción del Pez Verde: [...]

Leer másLa picadura del Pez Piedra, miembro de la familia Scorpaenidae o Pez Escorpión, es un evento que puede acarrear graves consecuencias. Estos peces, que también incluyen al pez cebra y al pez león, son maestros del camuflaje en su entorno marino. Portadores de un veneno extremadamente tóxico en sus espinosas aletas, las picaduras de estos animales [...]

Leer másEl tiburón de punta negra, científicamente conocido como Carcharhinus melanopterus, es una especie de tiburón de tamaño mediano que se encuentra en aguas cálidas y tropicales de todo el mundo. A continuación se detallan algunas características y aspectos relevantes de este fascinante depredador marino: Taxonomía del Tiburón de Punta Negra [...]

Leer másEl caracol asesino, científicamente conocido como Clea helena, es una especie de caracol carnívoro originario del sudeste asiático. Se caracteriza por su concha cónica de color amarillo-verdoso con rayas y manchas oscuras, y por su capacidad para alimentarse de otros caracoles, incluidos los caracoles de agua dulce considerados plagas en los [...]

Leer más